South America’s railway market is one that has been on the rise in recent years. With numerous infrastructure projects underway, it is no surprise that this market has become a major focus for rail equipment manufacturers, operators, and investors alike.

One of the reasons for this growth is the increasing demand for railways as a means of transportation. In a region that has long been dominated by road transport, railways provide a more efficient and cost-effective way to move people and goods. This trend is especially visible in Brazil, where railway usage has increased significantly over the past few years, driven by government investment in new infrastructure.

Another reason for this growth is the rising demand for raw materials, particularly from China. As South America is a major producer of commodities such as iron ore, soybeans, and oil, railways have become an important mode of transport for these goods. In addition, many of these commodities need to be transported from remote and hard-to-reach areas, making railways a crucial part of the supply chain.

However, despite the positive outlook for the South American railway market, there are also challenges that must be addressed. One major issue is the lack of investment in existing railway infrastructure. Many of the railways in South America are old and in need of maintenance, which not only limits their capacity but also poses safety risks. Additionally, bureaucratic hurdles and political instability can make it difficult for rail companies to secure funding for new projects.

Another challenge is the issue of competition, as railways are still competing with road transport for market share. While railways are generally considered to be more efficient than roads, they often require significant investment in infrastructure. This can make it difficult for smaller or regional operators to compete with larger, more established road transport companies.

In terms of the rail equipment market, there are also challenges to be faced. One of the main issues is the high cost of trains and equipment, which can make it difficult for operators to acquire new rolling stock. Additionally, many South American railways have unique gauge systems and other technical requirements, which can limit the availability of compatible equipment.

Despite these challenges, the South American railway market continues to offer great potential for growth. The region’s rich natural resources, growing population, and increasing demand for efficient transportation all point towards a bright future for railways in the region. However, it will require significant investment in infrastructure, technology, and training, as well as a commitment to innovation and collaboration between industry stakeholders, to fully realize this potential.

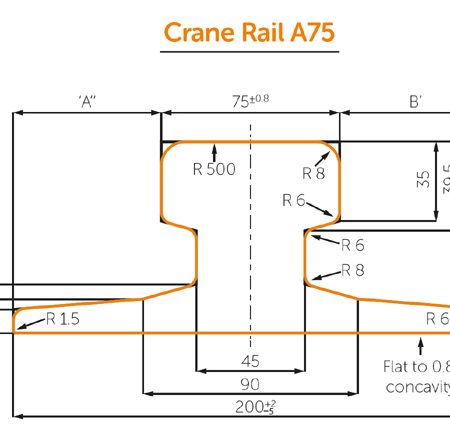

Welcome to ask us the international standard flat bottom rails as below: